Since the start of the year, I have been doing a lot of reading on the

CPF system and many opinions on it. While I am still unconvinced about

voluntarily contributing to CPF, I have been deliberating on what to do

with the monies in CPF-OA.

Personally, I view the CPF as the "last line of defense" in our

financial wealth. Hence, we should definitely spend some time to learn

about it and manage it.

I have read extensively on 2 mainstream arguments, and their opposing

stance can be best-represented by 2 bloggers. I will just summarize

their points below:

AK and his CPF-SA

AK advocates transferring monies from OA to SA account while you are

young to allow compounding to work its magic. Guess what, he receives

more than $8000 a year from SA interest alone!!!

With the kind of interest he's getting, it is more than enough to cover

all future minimum sum increases. Basically, his stance is to 'make full

use of the government' to help you save for your retirement.

Some research: If say I transfer $20K from OA to SA (an additional 1.5 -

2.5% interest), I will receive an additional $600+ every year. That

will result in an additional $20K in about 20 years time, and will

definitely go a long way in meeting the minimum sum!

The appealing part of this is while we are young, our contribution

percentage to SA is very low. However, SA pays the highest interest (5%

on the first $40,000). If you are willing to give up the flexibility of

OA, that extra 2.5% will grow your money much faster. Once it reaches a

substantial amount, you no longer need to worry about future minimum

sum increases.

Note: A possible "good problem" is that if your SA reaches the minimum

sum, you can no longer do voluntarily contribution to reduce tax.

--------------------------------------------------------------------------------------------------------------------------

Keith from Investment Moats

On the other side, Keith highlighted the dangerous of doing such transfers.

Flexibility and Safety - Even though I have no intentions of

wiping out my OA for housing, it's still a safety net. What if you lose

your job and is unable to service your mortgage? OA gives you that last

line of safety.

Political risks - It's 25 years to withdrawal and who knows how

the rules may have changed by then. However unlikely, they may increase

withdrawal age, reduce SA interest, etc... It's a risk of the unknown

that we have to keep in mind.

Opportunity Costs - I am in a huge dilemma because of this. Doing

the transfers "locks in" your monies until 55, at a fixed interest of

2.5%. There is the potential cost of delayed financial independence.

--------------------------------------------------------------------------------------------------------------------------

It's a choice between safety and opportunity.

In the end, the deal-breaker for me came down to this: Can I beat the 2.5% "risk free" rate in OA account?

According to the media, over 80% failed to do so. I find that quite

unbelievable because the STI provides an average returns of 6% (as of

now) over the long term. There's a few possibilities:

- Selective reporting in bear markets.

- Same reason why 90% of traders/hedge funds fail to beat the market, but 2.5% is really not high in my opinion.

All I need to do is to buy the STI, keep calm and collect dividends.

This is especially so given the recent 25% correction (dropping from

3500 to 2600) - the yield alone (as of now) is already 3.6%, even if we

were to exclude capital appreciation altogether). With that, I should

hopefully beat the OA and possibly SA returns.

Even though I've never been through the GFC, I know I am not the kind of

person that would panic-sell. I know I am a long-term investor, and I

believe in the future of Singapore.

And so, I abandoned my initial plan of doing an OA to SA transfer, and

opened an CPFIS account. I think I would re-look into doing a SA

transfer in the near future if the market recovers and the investment

pays off.

In conclusion, I still look at CPF-SA as a final safety net that I would

likely never touch, unless some black swan event happens where STI

crashes below 1500. 5% risk free interest rate is very very good good.

On the other hand, I also want to adopt AK strategy, give myself a peace

of mind and build up this safety net while I am young.

This is a financial blog documenting the investment journey of an average Singaporean graduate. Join me on my journey towards financial freedom through my investments in ZZ Holdings.

Saturday, January 16, 2016

Thursday, December 31, 2015

Year In Review 2015 - Financial Cash Flow

My first full year of the most comprehensive and detailed income/expenditures tracking finally completed!

*All figures exclude CPF, investment capital gains/losses (but include dividends).

-------------------------------------------------------------------------------------------------------------------------

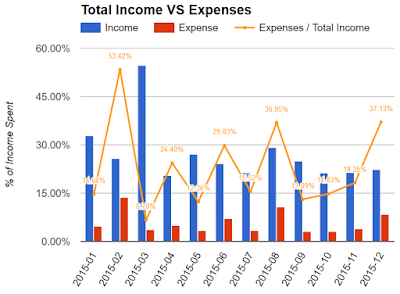

Total Income VS Total Expenses

Expenses were pretty much stable except for the months where I made "major purchases", most notably a new mattress in February, Dividend Machine course in April, Langkawi trip in June, Samsung Galaxy S6 in August, Cameron Trip + S6 repairs in December. I also spent slightly more on minor indulgence stuff in December to 慰劳 myself a bit.

Income were highest in January and March from bonuses, and there's a minor National Day bonus in August. Can't wait for the upcoming one to top-up my war chest!

Other

fluctuations in income are mostly due to dividends payout. Being my

first year of investing, this will take some time to stabalize as I

"lock down" on the stocks I have (receiving full year worth of

dividends), and having each subsequent purchase make up less of my

portfolio.

Other

fluctuations in income are mostly due to dividends payout. Being my

first year of investing, this will take some time to stabalize as I

"lock down" on the stocks I have (receiving full year worth of

dividends), and having each subsequent purchase make up less of my

portfolio.

Overall, I managed to saved near 82% of my total income. My plan is to reinvest and inject at least 70% into my portfolio every year. Let's get the snowball rolling!

-------------------------------------------------------------------------------------------------------------------------

Recurring Income VS Recurring Expenses

The chart strips out the noise and highlight only the "recurring" portion of my cashflow.

Recurring income include only salary + passive income, and excludes 'one-time' items like lottery winnings, angbaos, SAF allowance, bank special promotions, etc...

Recurring expenses remove all "major purchases" and "vacations".

-------------------------------------------------------------------------------------------------------------------------

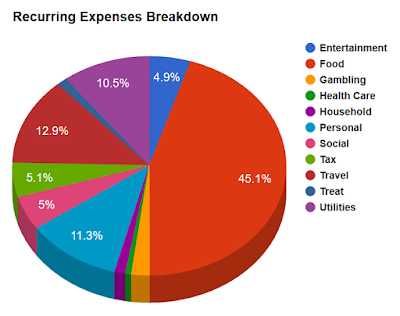

Recurring Expenses Breakdown

As expected, my top expenses are food, utilities, personal and travel. Other random discoveries:

- I spent about $12-$15 on average each month on lottery tickets. -.- So far, I only "won" $10 back. They are indeed a bad investment. Treat them purely as entertainment.

- Of all the entertainment expenses, about 50% of them comes from KTV sessions. LOL. Does it imply most of my entertainment come from singing, or is it because singing is the most expensive form of entertainment?

Food: Breakfast, Lunch, Dinner, Supper, Snack, Groceries

Entertainment: Any form of entertainment expenses such as KTV, Video Games (e.g. Purchases from Steam), Movies, Sports, Etc

Gambling: Any Losses from Lottery, Mahjong, etc...

Healthcare: Doctor, Dentist

Household: Consumables (e.g. Stationary, Toiletries), Others (e.g. Pillow, Bedsheets)

Personal: Things that are consumed personally by me, such as Clothing (e.g. Head to Toes), Haircut, Personal Care (e.g. Toothpaste, Skincare, Grooming), Other (i.e Exercise Stuff, Army)

Social: Wedding, Social Functions

Tax: Income Tax

Travel: Public (e.g. EZ-Link Topup), Taxi

Treat: Non-personal expenses

Utilities: Telephone, Internet

----------------------------------------------------------------------------------------------------------------------

Road To Financial Independence

Passive income now cover almost 20% of my expense! Not bad for my first full year of investing!

I have exceeded my goal for 2015 by collecting more passive income. The short term negative impact though - it's like exchanging "capital losses" in the process.

Given the market correction (i.e Great Singapore Sale), I will selectively accumulate on weakness to further accelerate my yield next year. Goal next year is to generate 1 month salary from stock dividends.

*All figures exclude CPF, investment capital gains/losses (but include dividends).

-------------------------------------------------------------------------------------------------------------------------

Total Income VS Total Expenses

Expenses were pretty much stable except for the months where I made "major purchases", most notably a new mattress in February, Dividend Machine course in April, Langkawi trip in June, Samsung Galaxy S6 in August, Cameron Trip + S6 repairs in December. I also spent slightly more on minor indulgence stuff in December to 慰劳 myself a bit.

Income were highest in January and March from bonuses, and there's a minor National Day bonus in August. Can't wait for the upcoming one to top-up my war chest!

Other

fluctuations in income are mostly due to dividends payout. Being my

first year of investing, this will take some time to stabalize as I

"lock down" on the stocks I have (receiving full year worth of

dividends), and having each subsequent purchase make up less of my

portfolio.

Other

fluctuations in income are mostly due to dividends payout. Being my

first year of investing, this will take some time to stabalize as I

"lock down" on the stocks I have (receiving full year worth of

dividends), and having each subsequent purchase make up less of my

portfolio.Overall, I managed to saved near 82% of my total income. My plan is to reinvest and inject at least 70% into my portfolio every year. Let's get the snowball rolling!

-------------------------------------------------------------------------------------------------------------------------

Recurring Income VS Recurring Expenses

The chart strips out the noise and highlight only the "recurring" portion of my cashflow.

Recurring income include only salary + passive income, and excludes 'one-time' items like lottery winnings, angbaos, SAF allowance, bank special promotions, etc...

Recurring expenses remove all "major purchases" and "vacations".

-------------------------------------------------------------------------------------------------------------------------

Recurring Expenses Breakdown

As expected, my top expenses are food, utilities, personal and travel. Other random discoveries:

- I spent about $12-$15 on average each month on lottery tickets. -.- So far, I only "won" $10 back. They are indeed a bad investment. Treat them purely as entertainment.

- Of all the entertainment expenses, about 50% of them comes from KTV sessions. LOL. Does it imply most of my entertainment come from singing, or is it because singing is the most expensive form of entertainment?

Food: Breakfast, Lunch, Dinner, Supper, Snack, Groceries

Entertainment: Any form of entertainment expenses such as KTV, Video Games (e.g. Purchases from Steam), Movies, Sports, Etc

Gambling: Any Losses from Lottery, Mahjong, etc...

Healthcare: Doctor, Dentist

Household: Consumables (e.g. Stationary, Toiletries), Others (e.g. Pillow, Bedsheets)

Personal: Things that are consumed personally by me, such as Clothing (e.g. Head to Toes), Haircut, Personal Care (e.g. Toothpaste, Skincare, Grooming), Other (i.e Exercise Stuff, Army)

Social: Wedding, Social Functions

Tax: Income Tax

Travel: Public (e.g. EZ-Link Topup), Taxi

Treat: Non-personal expenses

Utilities: Telephone, Internet

----------------------------------------------------------------------------------------------------------------------

Road To Financial Independence

Passive income now cover almost 20% of my expense! Not bad for my first full year of investing!

I have exceeded my goal for 2015 by collecting more passive income. The short term negative impact though - it's like exchanging "capital losses" in the process.

Given the market correction (i.e Great Singapore Sale), I will selectively accumulate on weakness to further accelerate my yield next year. Goal next year is to generate 1 month salary from stock dividends.

Tuesday, December 29, 2015

Year In Review 2015 - Financial Portfolio

2015 has not been a kind year to investors with the market taking

quite a beating. Most people would be in the red and I am no exception. I must be really 'heng' that that my first full year of investing is the hardest to make money in 78 years. Viewed

positively however, it's actually a good thing for someone in their

early stages of investing - It means I get to accumulate more companies

at fire-sale prices!

While I would like to think that I am "out-performing" the index, the sample size (investing period) is really too small to make any conclusion. Still, it's a consolation point to know that it's not because of my bad choices that I'm in the red - the whole market is going down.

Thankfully, I still have the majority of my holdings in cash. In 2016, I will look to selectively inject more into solid blue chips (with long term, sustainable dividends) to further diversify my holdings.

--------------------------------------------------------------------------------------------------------------------------

Next up will be a brief review of all my holdings and lessons learned:

Frasers Centrepoint Trust

My

first and most trusted holding. Each visit to causeway point just boost

my confidence in this company. Economic recession? Property downturn? I

don't think these macro-economic factors will make much of a dent on

FCT. It's amazing 8 years consecutive DPU increase is unmatched in the

REITs sector.

My

first and most trusted holding. Each visit to causeway point just boost

my confidence in this company. Economic recession? Property downturn? I

don't think these macro-economic factors will make much of a dent on

FCT. It's amazing 8 years consecutive DPU increase is unmatched in the

REITs sector.

This have provided me with the most stable and biggest returns since I started investing, and I intend to hold it forever.

Super Group

A

costly lesson in not blindly following analyst reports. I went in way

too early in the midst of a downturn, catching a falling knife in the

process. Have been holding on for several reasons:

A

costly lesson in not blindly following analyst reports. I went in way

too early in the midst of a downturn, catching a falling knife in the

process. Have been holding on for several reasons:

1) Cyclical stock that should turn-around eventually.

2) Strong balance sheet, good management and still profit-making.

3) The nose-dive makes this only a small portion of my portoflio now, so there is really no point selling anyway.

Keeping my fingers cross that its newly launched Essenso coffee will take off.

China Merchant Pacific Holdings

Another

one of my "dividend cash-cow". It has a diversified portfolio of 8 toll

roads now in China. While there are worries of slowing China growth, I

am satisfied with the current yield.

Another

one of my "dividend cash-cow". It has a diversified portfolio of 8 toll

roads now in China. While there are worries of slowing China growth, I

am satisfied with the current yield.

The interest hike has been weighing down on the stock price, but with its track record and strong parent backing, it's the least of my worries.

Like FCT, I intend to hold this for a long time. Keep calm and collect dividends!

Sembcorp Industries

OUCH!

To be fair, no one could have foresee oil prices plummeting from $120+

to $40. Sembcorp has been massacred, burning many people in the

process.It was so bad that Marine even posted a loss for the first time

in the company history. Thankfully, the Utilities are helping to offset

the losses, with potential growth coming from overseas segment.

OUCH!

To be fair, no one could have foresee oil prices plummeting from $120+

to $40. Sembcorp has been massacred, burning many people in the

process.It was so bad that Marine even posted a loss for the first time

in the company history. Thankfully, the Utilities are helping to offset

the losses, with potential growth coming from overseas segment.

Not going to sell this as I still believe strongly in "ah gong" stocks. At the same time, I can't average down as it will make me too over-weighted in a single company. If opportunity arises, I may look to "average down" via Keppel Corp to capitalize on the potential oil recovery.

M1

A

valuable lesson to be learn about being patient. I was too hasty to

deploy my cash after my bonus and didn't wait for a more opportune

moment (like now! A Telco with 7% yield now are you kidding me!).

A

valuable lesson to be learn about being patient. I was too hasty to

deploy my cash after my bonus and didn't wait for a more opportune

moment (like now! A Telco with 7% yield now are you kidding me!).

Many fellow investors, myself included, did not expect the 4th Telco news to impact M1 so negatively.

Its fundamentals didn't change much at all - earnings were still growing steadily and they are exploring new avenues of growth. To me, it's really cheap now and I would definitely want to buy if it weren't for the same ugly problem of over-concentration.

Just think about it. 4th Telco or not, we are heading for 6.9 million population. That means more people, more subscribers, more money for Telcos. If I could, I will definitely buy every single Telco and wait for 2030. Confirm huat lah!

Capital Commercial Trust

While the price has taken quite a beating after I brought, I am quite comfortable with this holding.

While the price has taken quite a beating after I brought, I am quite comfortable with this holding.

1. I entered at a reasonable price, with a good 20% discount to NAV, near its 52 week and historical P/E low.

2. Confidence in the management track records and grade A properties.

Even though there are headwinds of office over-supply, I don't think it will impact the DPU too badly. In the best case, CapitaGreen should provide some form of growth. In the worst case, a stagnating DPU for next 2 years - still satisfactory for me.

Accordia Golf Trust

I already know this is quite a 'risky' buy, but definitely didn't expect the DPU to drop so drastically. A few reasons why I brought:

1. Seduced by its unbelievably high yield (>10%) and 30% discount to NAV.

2. The false sense of security that "it can't get much lower!" (30+% from IPO price), a deadly fallacy.

3. Convinced by several bloggers - AK is still fighting on, B has backed out.

I am still holding on for its current annualized 7.2% yield, albeit with more risk. The management has been touting the return of golf to the 2016 Oylmpic Games as a growth pillar. Let's see if that comes true.

Straits Times Index

I have been deliberating between the various banks when the bear hits in September. In the end, I fled to safety and brought the STI. Haha.

This is a safety net for me, and I entered at a really good price. Now the issue is when, or should I sell? Looking to add either DBS or OCBC if I do sell this.

While I would like to think that I am "out-performing" the index, the sample size (investing period) is really too small to make any conclusion. Still, it's a consolation point to know that it's not because of my bad choices that I'm in the red - the whole market is going down.

Thankfully, I still have the majority of my holdings in cash. In 2016, I will look to selectively inject more into solid blue chips (with long term, sustainable dividends) to further diversify my holdings.

--------------------------------------------------------------------------------------------------------------------------

Next up will be a brief review of all my holdings and lessons learned:

Frasers Centrepoint Trust

My

first and most trusted holding. Each visit to causeway point just boost

my confidence in this company. Economic recession? Property downturn? I

don't think these macro-economic factors will make much of a dent on

FCT. It's amazing 8 years consecutive DPU increase is unmatched in the

REITs sector.

My

first and most trusted holding. Each visit to causeway point just boost

my confidence in this company. Economic recession? Property downturn? I

don't think these macro-economic factors will make much of a dent on

FCT. It's amazing 8 years consecutive DPU increase is unmatched in the

REITs sector.This have provided me with the most stable and biggest returns since I started investing, and I intend to hold it forever.

Super Group

A

costly lesson in not blindly following analyst reports. I went in way

too early in the midst of a downturn, catching a falling knife in the

process. Have been holding on for several reasons:

A

costly lesson in not blindly following analyst reports. I went in way

too early in the midst of a downturn, catching a falling knife in the

process. Have been holding on for several reasons:1) Cyclical stock that should turn-around eventually.

2) Strong balance sheet, good management and still profit-making.

3) The nose-dive makes this only a small portion of my portoflio now, so there is really no point selling anyway.

Keeping my fingers cross that its newly launched Essenso coffee will take off.

China Merchant Pacific Holdings

Another

one of my "dividend cash-cow". It has a diversified portfolio of 8 toll

roads now in China. While there are worries of slowing China growth, I

am satisfied with the current yield.

Another

one of my "dividend cash-cow". It has a diversified portfolio of 8 toll

roads now in China. While there are worries of slowing China growth, I

am satisfied with the current yield. The interest hike has been weighing down on the stock price, but with its track record and strong parent backing, it's the least of my worries.

Like FCT, I intend to hold this for a long time. Keep calm and collect dividends!

Sembcorp Industries

OUCH!

To be fair, no one could have foresee oil prices plummeting from $120+

to $40. Sembcorp has been massacred, burning many people in the

process.It was so bad that Marine even posted a loss for the first time

in the company history. Thankfully, the Utilities are helping to offset

the losses, with potential growth coming from overseas segment.

OUCH!

To be fair, no one could have foresee oil prices plummeting from $120+

to $40. Sembcorp has been massacred, burning many people in the

process.It was so bad that Marine even posted a loss for the first time

in the company history. Thankfully, the Utilities are helping to offset

the losses, with potential growth coming from overseas segment.Not going to sell this as I still believe strongly in "ah gong" stocks. At the same time, I can't average down as it will make me too over-weighted in a single company. If opportunity arises, I may look to "average down" via Keppel Corp to capitalize on the potential oil recovery.

M1

A

valuable lesson to be learn about being patient. I was too hasty to

deploy my cash after my bonus and didn't wait for a more opportune

moment (like now! A Telco with 7% yield now are you kidding me!).

A

valuable lesson to be learn about being patient. I was too hasty to

deploy my cash after my bonus and didn't wait for a more opportune

moment (like now! A Telco with 7% yield now are you kidding me!).Many fellow investors, myself included, did not expect the 4th Telco news to impact M1 so negatively.

Its fundamentals didn't change much at all - earnings were still growing steadily and they are exploring new avenues of growth. To me, it's really cheap now and I would definitely want to buy if it weren't for the same ugly problem of over-concentration.

Just think about it. 4th Telco or not, we are heading for 6.9 million population. That means more people, more subscribers, more money for Telcos. If I could, I will definitely buy every single Telco and wait for 2030. Confirm huat lah!

Capital Commercial Trust

While the price has taken quite a beating after I brought, I am quite comfortable with this holding.

While the price has taken quite a beating after I brought, I am quite comfortable with this holding.1. I entered at a reasonable price, with a good 20% discount to NAV, near its 52 week and historical P/E low.

2. Confidence in the management track records and grade A properties.

Even though there are headwinds of office over-supply, I don't think it will impact the DPU too badly. In the best case, CapitaGreen should provide some form of growth. In the worst case, a stagnating DPU for next 2 years - still satisfactory for me.

Accordia Golf Trust

I already know this is quite a 'risky' buy, but definitely didn't expect the DPU to drop so drastically. A few reasons why I brought:

1. Seduced by its unbelievably high yield (>10%) and 30% discount to NAV.

2. The false sense of security that "it can't get much lower!" (30+% from IPO price), a deadly fallacy.

3. Convinced by several bloggers - AK is still fighting on, B has backed out.

I am still holding on for its current annualized 7.2% yield, albeit with more risk. The management has been touting the return of golf to the 2016 Oylmpic Games as a growth pillar. Let's see if that comes true.

Straits Times Index

I have been deliberating between the various banks when the bear hits in September. In the end, I fled to safety and brought the STI. Haha.

This is a safety net for me, and I entered at a really good price. Now the issue is when, or should I sell? Looking to add either DBS or OCBC if I do sell this.

Saturday, December 26, 2015

To My Future FI Self

Hopefully, you've managed to achieved FI before the age of 40. Are you planning to retire/semi-retire already?

Unfortunately, this is not something that is socially acceptable in Singapore. Your friends and families probably think it's a crazy, absurd dream. In a society where we are encouraged to work until we are 67 years old, wanting to retire early sounds ridiculous. You will be criticized or deem as weird/lazy. Quote from a fellow investor who reached FIRE:

"I had trouble convincing authorities that I was not a burden to the tax-payer in spite of being an unemployed law student. Our government is still not equipped with the procedures to cover income investors. I had to compile a report on dividend cash flows and had to deal with an ICA officer who was just puzzled that "stock market sends me money on regular basis". In a more unsophisticated country, I would have been accused of practicing witchcraft.

The second incident which may have killed my retirement plan is when I tried to hire a maid to look after my dad. Without an earned income in my IRAS filings, I was not allowed to be the sponsor. My dad had to put in his spare cash of $50,000 into a fixed deposit to sponsor his own maid as all my money is tied up in my CDP. This convinced me that Singapore society, as affluent as it is, it does not have the infrastructure in place to recognise dividends cash flow as a valid substitute for earned income. A CDP statement, no matter how large, is no substitute for a FD account which puts us in a bind because of the cash drag."

Perhaps that's why I haven't been sharing this dream of mine with many people. B sums up this dilemma perfectly in his recent post.

It's like getting married. It's something we are expected to do out of social norms, regardless of how much pain it would bring us.

If you are already FI, you shall remember and follow these advice:

-----------------------------------------------------------------------------------------------------------------

1. Thou shalt not become a slave of money

It will be difficult to give up working when you realize how much income you will lose, even after you have enough passive income to live without working. It will be tempting to chase after more and more zeroes in your bank account. This will never end - humans greed are limitless.

Before you know it, you'll reach the end of your life being a slave to money. Do not let that happen to you. Do not let society norms determine your future.

2. Thou shalt follow your heart, dreams and passion

You promised that you will do that. Remember your initial goal when you started on this journey.

Your dream job pays much lesser than your current one? You can afford to switch now.

You wanted to take a long sabbatical to enjoy life? Do it.

You wanted to go back to school, learn something new? Do it.

Do not falter. Do not forget the initial reason you started on the journey to FI.

3. Thou shalt not shift your goalpost.

It's easy to shift goal post and make the criteria for achieving FI harder and harder.

While it is prudent to take inflation and cost of living into account, you must not adjust your lifestyle to chase higher material wealth, making it so you never reach the goal.

Remember the value you set initially and adjust it accordingly.

4. Thou shalt regularly evaluate your financial situation

Remember, it doesn't mean you have to stop working for the rest of your years. We need to set in buffer for financial crisis and bad times.

Do not squander your portfolio. Do not spend your invested capital. Only spend the dividends, with enough left over to reinvest and grow your portfolio.

Unfortunately, this is not something that is socially acceptable in Singapore. Your friends and families probably think it's a crazy, absurd dream. In a society where we are encouraged to work until we are 67 years old, wanting to retire early sounds ridiculous. You will be criticized or deem as weird/lazy. Quote from a fellow investor who reached FIRE:

"I had trouble convincing authorities that I was not a burden to the tax-payer in spite of being an unemployed law student. Our government is still not equipped with the procedures to cover income investors. I had to compile a report on dividend cash flows and had to deal with an ICA officer who was just puzzled that "stock market sends me money on regular basis". In a more unsophisticated country, I would have been accused of practicing witchcraft.

The second incident which may have killed my retirement plan is when I tried to hire a maid to look after my dad. Without an earned income in my IRAS filings, I was not allowed to be the sponsor. My dad had to put in his spare cash of $50,000 into a fixed deposit to sponsor his own maid as all my money is tied up in my CDP. This convinced me that Singapore society, as affluent as it is, it does not have the infrastructure in place to recognise dividends cash flow as a valid substitute for earned income. A CDP statement, no matter how large, is no substitute for a FD account which puts us in a bind because of the cash drag."

Perhaps that's why I haven't been sharing this dream of mine with many people. B sums up this dilemma perfectly in his recent post.

It's like getting married. It's something we are expected to do out of social norms, regardless of how much pain it would bring us.

If you are already FI, you shall remember and follow these advice:

-----------------------------------------------------------------------------------------------------------------

1. Thou shalt not become a slave of money

It will be difficult to give up working when you realize how much income you will lose, even after you have enough passive income to live without working. It will be tempting to chase after more and more zeroes in your bank account. This will never end - humans greed are limitless.

Before you know it, you'll reach the end of your life being a slave to money. Do not let that happen to you. Do not let society norms determine your future.

2. Thou shalt follow your heart, dreams and passion

You promised that you will do that. Remember your initial goal when you started on this journey.

Your dream job pays much lesser than your current one? You can afford to switch now.

You wanted to take a long sabbatical to enjoy life? Do it.

You wanted to go back to school, learn something new? Do it.

Do not falter. Do not forget the initial reason you started on the journey to FI.

3. Thou shalt not shift your goalpost.

It's easy to shift goal post and make the criteria for achieving FI harder and harder.

While it is prudent to take inflation and cost of living into account, you must not adjust your lifestyle to chase higher material wealth, making it so you never reach the goal.

Remember the value you set initially and adjust it accordingly.

4. Thou shalt regularly evaluate your financial situation

Remember, it doesn't mean you have to stop working for the rest of your years. We need to set in buffer for financial crisis and bad times.

Do not squander your portfolio. Do not spend your invested capital. Only spend the dividends, with enough left over to reinvest and grow your portfolio.

Tuesday, December 22, 2015

F-You Money

Recently, I learnt a new term known as "F-You Money". The concept is

entirely familiar to me, but I never thought of using such a

straightforward, in your face term to describe it.

You can read this article to understand F-You Money in all its glory.

Interested?

This guy wrote one of the simplest, no-nonsense article about the path to wealth accumulation, and I highly recommend you read it.

One small regret I have was not bookmarking down a lot of good financial articles I came across this year. I'll try to jot and compile these down into a list in the future.

You can read this article to understand F-You Money in all its glory.

Interested?

This guy wrote one of the simplest, no-nonsense article about the path to wealth accumulation, and I highly recommend you read it.

One small regret I have was not bookmarking down a lot of good financial articles I came across this year. I'll try to jot and compile these down into a list in the future.

Saturday, December 12, 2015

10 Years - Road To Financial Independence

29 years old! How quickly time flies.

This is one of the most "turbulent" year of my life, with many obstacles and down period. Looking forward to the 2 weeks year end leave to recharge and re-organize.

As I don't forsee myself settling down anytime soon, there are few "life goals" I can make aside from financial ones. On the positive note, perhaps that isn't such a bad thing.

Come January, I will officially kick start my 10 years master plan to financial independence.

Having worked for 3+ years, I have reached a stage of relative stability - No debts, sufficient emergency funds, mini war chest and decent portfolio. I also just completed my first full year of investing, and while the results weren't pretty due to the minor market crash, I have learned many valuable lessons. It's also lucky that I'm experiencing a market correction early in my life.

I have mapped out a plan based on how much I can inject yearly, a conservative yield of 5% dividend and 5% capital gains, roughly based on this calculator. According to my calculations, it'll be 10 - 12 years until I gain financial independence. (Hopefully before I reach 40!)

*All these are based on assumptions that I remain single, don't purchase a property or raise a kid. They also excludes any wage raise, inflation and CPF calculations. Anyway, I shall write in more detail in the year end tabulation.

------------------------------------------------------------------------------------------------------------------------

What does it all mean then? Am I going to retire then?

Actually, financial independence has nothing to do with retiring. It got to do with the freedom of your life.

I've seen many people around me "suffer" from poor financial status, either minor or major.. They are scared of losing their jobs at 40 years old because they have no savings. They endured humiliation and pain because they have families to feed. They developed health problems but can't take time off to rest. They give up their dreams because their passion can't feed their lifestyle.

I really hope I don't become like that.

Who knows what will happen by the time I'm 40?

Will I still have passion for technology? Will I still have the the energy to do what I am doing now? Will I still be fit and healthy?

Or will I have developed new interests? Maybe I'll rot at home. Maybe I'll travel the world. Maybe I'll just continue working as normal.

The point is that whatever decision I make, money would no longer be a factor in it. I will have total control of my life.

This is one of the most "turbulent" year of my life, with many obstacles and down period. Looking forward to the 2 weeks year end leave to recharge and re-organize.

As I don't forsee myself settling down anytime soon, there are few "life goals" I can make aside from financial ones. On the positive note, perhaps that isn't such a bad thing.

Come January, I will officially kick start my 10 years master plan to financial independence.

Having worked for 3+ years, I have reached a stage of relative stability - No debts, sufficient emergency funds, mini war chest and decent portfolio. I also just completed my first full year of investing, and while the results weren't pretty due to the minor market crash, I have learned many valuable lessons. It's also lucky that I'm experiencing a market correction early in my life.

I have mapped out a plan based on how much I can inject yearly, a conservative yield of 5% dividend and 5% capital gains, roughly based on this calculator. According to my calculations, it'll be 10 - 12 years until I gain financial independence. (Hopefully before I reach 40!)

*All these are based on assumptions that I remain single, don't purchase a property or raise a kid. They also excludes any wage raise, inflation and CPF calculations. Anyway, I shall write in more detail in the year end tabulation.

------------------------------------------------------------------------------------------------------------------------

What does it all mean then? Am I going to retire then?

Actually, financial independence has nothing to do with retiring. It got to do with the freedom of your life.

I've seen many people around me "suffer" from poor financial status, either minor or major.. They are scared of losing their jobs at 40 years old because they have no savings. They endured humiliation and pain because they have families to feed. They developed health problems but can't take time off to rest. They give up their dreams because their passion can't feed their lifestyle.

I really hope I don't become like that.

Who knows what will happen by the time I'm 40?

Will I still have passion for technology? Will I still have the the energy to do what I am doing now? Will I still be fit and healthy?

Or will I have developed new interests? Maybe I'll rot at home. Maybe I'll travel the world. Maybe I'll just continue working as normal.

The point is that whatever decision I make, money would no longer be a factor in it. I will have total control of my life.

Wednesday, December 9, 2015

The Misunderstood Path of Frugality

Respected blogger Kyith from Investment Moats shared the story of how a man paid off his house mortgage in 3+ years by living a life of "poverty baseline". It's an extremely educational and enlightening read.

Instead of applauding and learning from him, the internet condemn his story with things like how he has no life and is a slave of money. I found it laughable.

The reason why we live a frugal life is exactly the opposite - we DON'T WANT to become slave of money. We can't afford to not be disciplined if we want to escape the money cycle while we are still young and energetic.

To re-quote from Felix (another 1 of my respected blogger):

"This current generation YOLO too much. YOLO can be meaningful at times, but often it is nothing but short term gain and long term pain.

YOLO after graduation, don't work, go travel a year. That's financial suicide.

The right way should be work 10 years, build your golden nest egg, and let your eggs give you a free holiday."

---------------------------------------------------------------------------------------------------------------------

I could not agree more.

It's all about discipline and delayed gratification.

And that is exactly what I am trying to do.

A 10 years path to financial independence.

Instead of applauding and learning from him, the internet condemn his story with things like how he has no life and is a slave of money. I found it laughable.

The reason why we live a frugal life is exactly the opposite - we DON'T WANT to become slave of money. We can't afford to not be disciplined if we want to escape the money cycle while we are still young and energetic.

To re-quote from Felix (another 1 of my respected blogger):

"This current generation YOLO too much. YOLO can be meaningful at times, but often it is nothing but short term gain and long term pain.

YOLO after graduation, don't work, go travel a year. That's financial suicide.

The right way should be work 10 years, build your golden nest egg, and let your eggs give you a free holiday."

---------------------------------------------------------------------------------------------------------------------

I could not agree more.

It's all about discipline and delayed gratification.

And that is exactly what I am trying to do.

A 10 years path to financial independence.

Subscribe to:

Posts (Atom)