The stock market continue its relentless ascend - The DOW is at all time high and cryptocurrency is all the craze nowadays. You know we are in a bubble when even uncles and students are trading cryptos. Humans never learn, do they?

“Bitcoin has no underlying rate of return,” said Bogle, 88, who started the first index fund in 1976. “You know bonds have an interest coupon, stocks have earnings and dividends, gold has nothing. There is nothing to support bitcoin except the hope that you will sell it to someone for more than you paid for it.” - Jack Bogle

Our portfolio underperformed this time, growing only 4.2% compared to 5.7% of the index. This is largely due to the lack of banks in our holdings. (greatly regret not buying OCBC/DBS last year). Nevertheless, we were able to ride on the growth of our REITs.

In the final quarter, we paid out about $600 in dividends (base on pay-date, hence excluding the massive injection from Singtel). We also became friends of SGXCafe in order to more accurately track our performance - look out for more statistics in our annual report!

Operating Highlights - Income

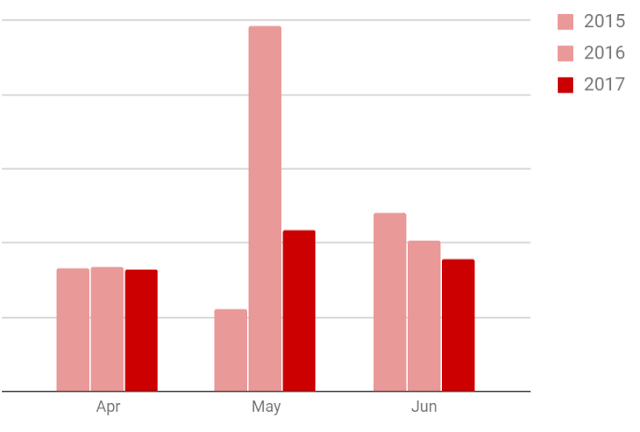

Overall income for the quarter was more than 50% higher compare to same period last year, making up for the 40% drop in Q1. Salary-wise, 2017Q4 was roughly equal to 2016Q1 due to shift in bonus period.

Aside from the bonus, income this quarter was pushed up by many factors:

- Passing with incentive for IPPT

- Birthday red packets from family

- Side "job" allowance

- Passive income a record for Q4.

Our big purchase this quarter was a Lenovo laptop, which we brought after much consideration. This is our first laptop purchase after nearly 10 years (last brought in 2008 for University). It has better specs (8th Gen i5) compared to the Microsoft Surface and come in at a much lower price (with Pen, Keyboard all inclusive). Overall, we think it is a good value deal that would make our life at work easier.

Otherwise, regular expense is 20% lesser than last year. We did not spend much except for a couple of clothing/shoes brought mostly during 11-11 sales.

We subscribed to CCT rights and add on to Singtel again on its continued weakness. Interestingly, we also brought Singtel during the same period last year.

We continue to believe that Singtel is currently at an attractive price and would buy more if we were not already heavily vested in it. Largest company in Singapore, 20 years dividend track record, mere 60+% payout ratio and a stable 4.8% yield.

Topping Up CPF

We seriously evaluated the possiblity of topping up our CPF to reduce tax - more specifically medisave. This is something we have been contemplating since 2014. The critical factor once again came down to our long term goal - do we want to retire after 55? Or earlier?

If your decision is to retire after 55, there is no doubt that topping up CPF is extremely attractive. In fact, we would advocate pumping as much as you can so that you can hit FRS by early 30s.

In the end, we still conclude that topping up contradict too much with our FIRE goal.

Outlook

More details to come in our Annual Report.